Trusted by first-time buyers nationwide

“Expert buyer guidance for the person ready for their first home.”

2026 Is Coming Fast — Don’t Spend Another Year Just Paying Rent

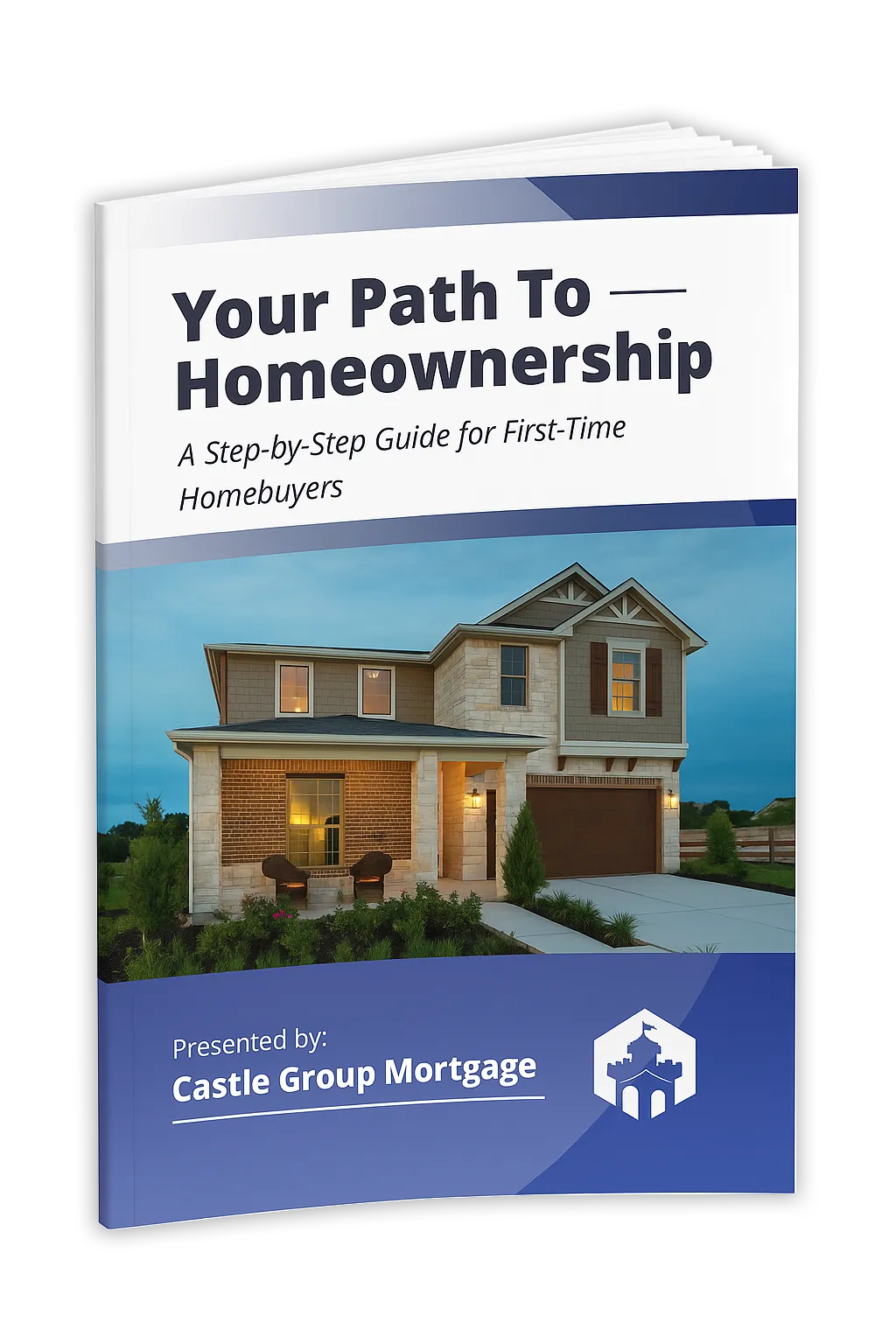

Download your FREE “Path to Homeownership” Guide and learn the simple steps to go from renter to first-time homeowner without the stress, confusion, or guesswork.

🔒 Free Instant Access — No spam. No obligations.

Here's What You'll Learn Inside

Buying your first home doesn’t have to feel like a mystery, a math exam, and a horror story all rolled into one. This guide breaks everything down in plain language so you actually understand what’s happening, what to do next, and how to avoid the “I wish someone told me that” moments.

In this FREE guide, you’ll discover:

How to know if you’re really ready to buy

Simple signs to look for in your budget, credit, and lifestyle before you start shopping.What lenders are actually looking at (in plain English)

No jargon. Just an honest breakdown of income, credit, debt, and what “pre-approval” really means.How much home you can realistically afford

So you’re not falling in love with houses that don’t fit your numbers.Ways to buy with a lower down payment than you think

Including programs and strategies most first-time buyers don’t even know exist.Common first-time buyer mistakes to avoid

The stuff that can cost you thousands or kill your deal at the last minute.A clear path from “thinking about it” to “getting the keys”

Step-by-step, from deciding to buy → getting pre-approved → house hunting → closing day.

Build Long-Term Homeowner Wealth

Your home isn’t just where you live, it’s still the #1 wealth-building asset for your retirement.

SMART HOME-BUYING STRATEGY

Learn why you don't have to fear the buying process. Everything from getting your loan to getting the home inspection!

YOUR FIRST-HOME BLUEPRINT

Understand how the experts help you save money, build equity faster, and avoid costly mistakes — from pre-approval to closing day and beyond.

This guide is designed specifically for:

Renters who are tired of paying someone else’s mortgage every month.

First-time buyers who feel overwhelmed by the process and don’t know where to start.

Growing families who need more space but are nervous about “making a mistake.”

Anyone who’s thought “maybe next year” more than once when it comes to buying a home.

If you’ve ever said, “I want to buy, I just don’t know how or if I even can,” this guide was created for you.

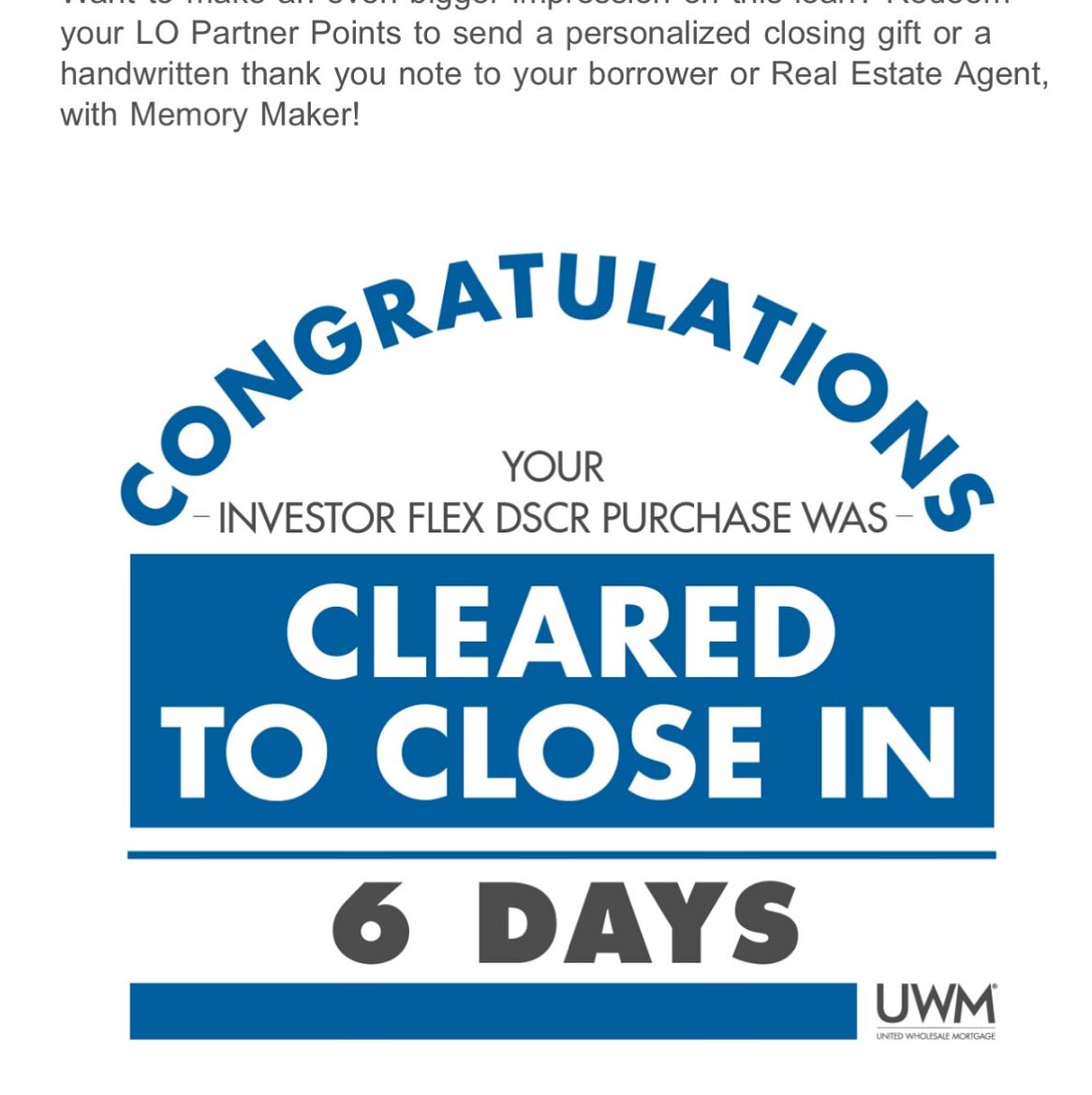

Great results with some of our clients.

Meet Your Home Ownership Experts

"We created this guide to help you understand that Home Ownership is very possible with smart financing, strategic planning, and personalized mortgage solutions.

— Lorenzo S

Chief Growth Officer, Castle Group Mortgage

Lorenzo Salas is a marketing strategist, and Loan Officer with Castle Group Mortgage with a passion to help everyday Americans achieve the dream of home ownership.

— Joseph C

President & Senior Loan Advisor, Castle Group Mortgage

A visionary leader and entrepreneur, Mr. Castillo is the Founder and President of Castle Group Mortgage Corp, established in 2020. He is dedicated to helping individuals and families with personalized mortgage solutions, helping them achieve their real estate dreams.

I was nervous about buying my first home, but Castle Group made it feel easy. They broke everything down in simple terms and made sure I understood my options. I’d recommend them to anyone who wants real guidance, not sales talk

Jaime L.

Got Question?

We've got answers

In your freelancing journey, you likely have many questions and concerns. Our goal is to help you navigate through them, which is why we've compiled answers to the most common questions. Whether you need insights on budgeting, taxes, or financial planning, our comprehensive FAQ section is here for you. If you don’t find your question listed, feel free to ask us—we’re here to assist you!

What are the best budgeting practices for freelancers?

Freelancers should track all income and expenses meticulously. Consider using budgeting apps or spreadsheets to categorize expenses and set financial goals. Aim to save a portion of your income each month to cover lean periods.

How do I handle taxes as a freelancer?

As a freelancer, you are responsible for reporting your income and paying taxes. It's essential to keep detailed records of your earnings and expenses. You may want to consult a tax professional to understand your obligations and maximize deductions.

What should I include in my financial plan?

A comprehensive financial plan for freelancers should include budgeting, savings goals, retirement planning, and an emergency fund. Additionally, consider setting aside money for taxes and investing in professional development.

How can I manage irregular income?

Managing irregular income involves creating a buffer. Set aside a portion of your earnings during high-earning months to cover expenses during leaner times. Building an emergency fund can also provide stability and peace of mind.

What are the advantages of having a separate business account?

Having a separate business account helps streamline your finances by keeping personal and business expenses distinct. This makes it easier to track income, manage cash flow, and prepare for taxes, reducing the risk of financial confusion.

Get insider guidance from mortgage experts who help first-time buyers win in today’s market.

Unlock Your Path to Home Ownership Today,

Path to Home Ownership Starts Here.

Equal Housing Lender | NMLS #2657191 | Licensed in FL, TX

We do not discriminate on the basis of race, color, religion, sex, disabilities status or national origin in the sale, rental, or financing of dwellings

Need help? Email [email protected] or call (866) 741-5999.

Copyrights 2025 | All Rights Reserved